Ma payroll calculator

Employers can use it to calculate net pay and figure out how. A single filer will.

How To Calculate Net Pay Step By Step Example

You first need to enter basic information about the type of payments you make.

. Payroll Tax Salary Paycheck Calculator Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

This calculation is also subject to a cap that in 2022. Massachusetts Paycheck Calculator - SmartAsset SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible.

Heres a step-by-step guide to walk you through. In 2015 FUTA tax percentage is 06 percent of the first 7000 of wages per year. The maximum an employee will pay in 2022 is 911400.

For example if an employee earns 1500. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Federal Salary Paycheck Calculator.

For example if an employee earns 1500 per week the individuals annual. Payroll management made easy. Summarize deductions retirement savings required taxes and more.

The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes.

Find out how easy it is to manage your payroll today. If you need more flexible and better payroll calculation such as generating EA Formautomatically or adding allowance that does not contribute to PCB EPF or SOCSO you may want to check. How to use a Payroll Online Deductions Calculator.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. It will confirm the deductions you include on your. Small Business Low-Priced Payroll Service.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. If youre checking your payroll.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Employers pay FUTA tax based on employee wages or salaries.

Ad With world-class global hiring and payments our competitors dont come Remote-ly close. Ad With world-class global hiring and payments our competitors dont come Remote-ly close. As the global market leader in worldwide hiring get faster onboarding and in-app support.

Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. The tool then asks you. Use this calculator to see how inflation will change your pay in real terms.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. A payroll or paycheck calculator is a tool that calculates tax withholdings and other deductions from an employees gross pay which makes it easier to give your employees. Salary commission or pension.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. 3 Months Free Trial. All other pay frequency inputs are assumed to.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Input the date of you last pay rise when your current pay was set and find out where your current salary has. Thus the maximum annual amount of FUTA.

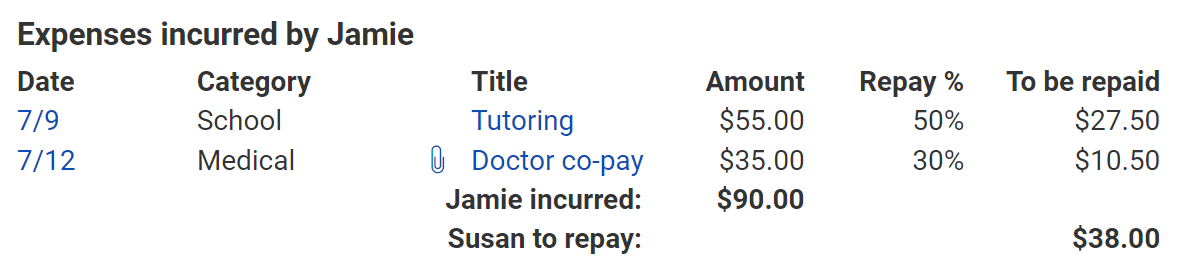

Free Online Payroll Tax Calculator. View FSA Calculator A. Contribution rate split for employers with fewer than 25 covered individuals.

How much do you make after taxes in Massachusetts. As the global market leader in worldwide hiring get faster onboarding and in-app support.

Payroll Tax Calculator For Employers Gusto

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Calculate The Molar Mass Of Ethanol C2h5oh Molar Mass Practice Youtube

2022 Federal State Payroll Tax Rates For Employers

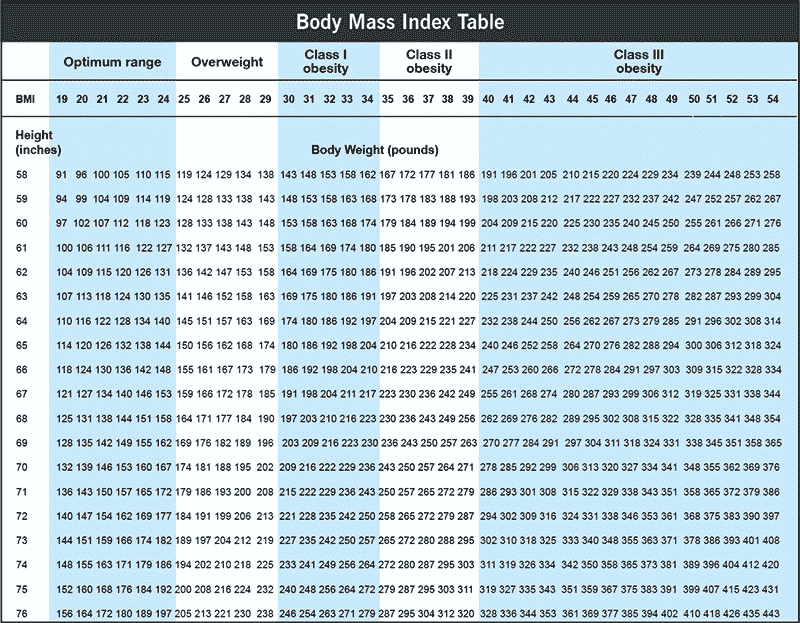

Bmi Body Mass Index What It Is How To Calculate

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

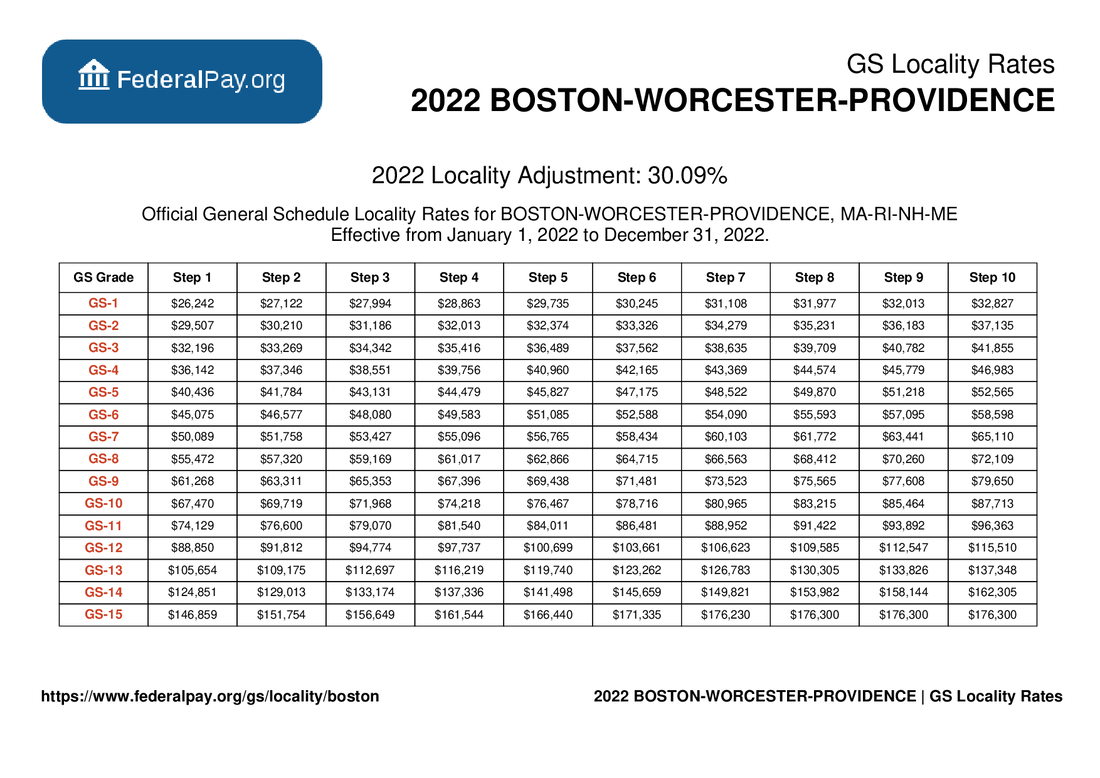

Boston Pay Locality General Schedule Pay Areas

How To Calculate Payroll Taxes Methods Examples More

Dmv Fees By State Usa Manual Car Registration Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

The Easiest Massachusetts Child Support Calculator Instant Live

Here S How Much Money You Take Home From A 75 000 Salary

3 Ways To Calculate Your Hourly Rate Wikihow

Estimate Your Cost Mit Student Financial Services